Abstract

This discussion paper addresses mainstream versions of Universal Basic Income and presents the original policy alternative idea named Age-Indexed Basic Income. In mainstream forms of Universal Basic Income, the sum people get monthly should be the same, without any requirement. Universal Basic Income could simplify bureaucracy related to social benefits in countries that implement it; nonetheless, it is a too costly policy alternative. This cost issue can be exceptionally ticklish today, with most European governments having recently increased public debt levels due to the covid19 crisis. Many European countries already had high levels of public debt before this crisis. As a result, Universal Basic Income would likely require its implementation to cancel and or replace several existing social programs to be sustainable financially. Old-age pensions account for almost half of total social spending in the European Union, and most mainstream propositions of Universal Basic Income do not include replacing old-age pensions. The original concept of Age-Indexed Basic Income is a policy idea and alternative where Universal Basic Income would replace social benefits schemes such as unemployment benefits and anything from child benefits to old-age pensions. Replacing as many social programs as possible, the Age-Indexed Basic Income would simplify bureaucracy and make Universal Basic Income more realistic in financing it. It would be based on a model where people would receive Universal Basic Income during their whole life, but its level would vary depending on age. All of this would likewise make its implementation process extra complex, as more programs would be canceled and replaced. Existing research on Universal Basic Income will be employed to examine the cost of its mainstream versions. A look will be given at current social spending in European countries. These countries have diverse demographic and economic situations. However, redistribution reforms such as Universal Basic Income and the Age-Indexed Basic Income are adaptable in terms of how generous they are. The new Age-Indexed model will be analysed and briefly compared to mainstream variants of Universal Basic Income, employing a three-branch conceptual scheme on the attributes of well-functioning redistribution reform schemes. This scheme will comprise economic, political, and moral justifications for redistribution reform schemes to be suitable. This paper’s findings encompass that the Age-Indexed Basic Income has a lower net cost but a more troublesome policy process than mainstream versions of Universal Basic Income. Further in-depth research is required on the Age-Indexed Basic Income, looking at its net cost and using economic theory to understand its consequences on the national economy better. This article should serve as an opening for future systematic research on the complex problems linked to mainstream versions of Universal Basic Income and on the Age-Indexed Basic Income.

Keywords: Universal Basic Income, Age-Indexed Universal Basic Income, Welfare Policies, Redistribution System Innovations, Theory of Justice

- Introduction and aims

Current redistribution systems in developed countries have grown highly complicated and expensive, while not always solving involuntary part-time work, low labour force participation rates, high non-take-up rates, a continually evolving labour market, and unsteady contemporary societies. The most developed and generous current redistribution systems also do not always motivate populations to be active, creating welfare traps, for instance. Income inequality in OECD countries is at its highest level for the past half-century. The average income of the richest 10% of the population is about nine times that of the poorest 10% across the OECD, up from seven times 25 years ago.[1] Universal Basic Income (UBI) is a periodic cash payment unconditionally delivered to all on an individual basis, without means test or work requirement.[2] The concept of a UBI is not new. However, although many OECD countries have non-contributory, non-means tested benefits for certain groups (most commonly children or pensioners) no country has made a UBI the central pillar of its social security system. The recent upsurge in attention to UBI proposals in OECD countries, including in those with long-standing traditions of providing comprehensive social protection, is therefore remarkable.[3] UBI, as a policy alternative, is both expensive and challenging to implement. The potential total cost of such a reform depends not only on the amount distributed monthly multiplied by the number of people benefitting from it. It is also directly linked to the savings the reform could create by replacing existing programs and simplifying or even downsizing public administration. The more welfare programs can be replaced, the more affordable and realistic a future full-scale implementation becomes. UBI has never been implemented on a full-scale as totally unconditional, replacing most other cash transfer welfare programs. Furthermore, pilot programs generally add UBI instead of substituting most other welfare programs for it. In the Finnish pilot program, only unemployed people were concerned, making the implementation either conditional or costlier than it should be.

The Finnish pilot program results are often debated. As stated by Philippe Van Parijs, by showing a significant positive impact on employment, the experiment did not prove the economic sustainability of a basic income of €560, conditionally supplemented in the various ways mentioned above. Nor was it supposed to do so. (…) One striking result, for example, concerns the quarter of the subjects with a native language other than Finnish or Swedish. In this category, consisting mostly of recent immigrants, basic-income recipients worked on average 13 days more than the corresponding control group, whereas the difference was only 3.6 days for the others. Also significant is that the positive effect was less in Helsinki (1.8 more days of employment) than in rural municipalities (7.8 more days), where means-tested housing benefits are less frequent and lower and therefore the remaining unemployment trap is less deep. By contrast, despite the availability of means-tested child benefits, the positive effect of the basic-income regime was higher in households with children (13.7 more days) and for single parents (9.5 days) than in childless households (1.6 more days). No less interesting are the results based on a survey conducted at the end of the second year with members of the experimental and the control groups. These results were already recorded in the preliminary report and have been refined in the light of in-depth interviews. A statistically significant difference in favour of basic-income recipients emerged in their subjective perceptions of health and stress and their trust in other people and institutions. Making access to the formal labour market easier for the excluded is an important purpose of a basic-income reform. But it is by no means the only one. Its far broader aim is to make our economy more resilient and our society more just, by increasing the economic security and freedom of choice of those with least of those.[4]

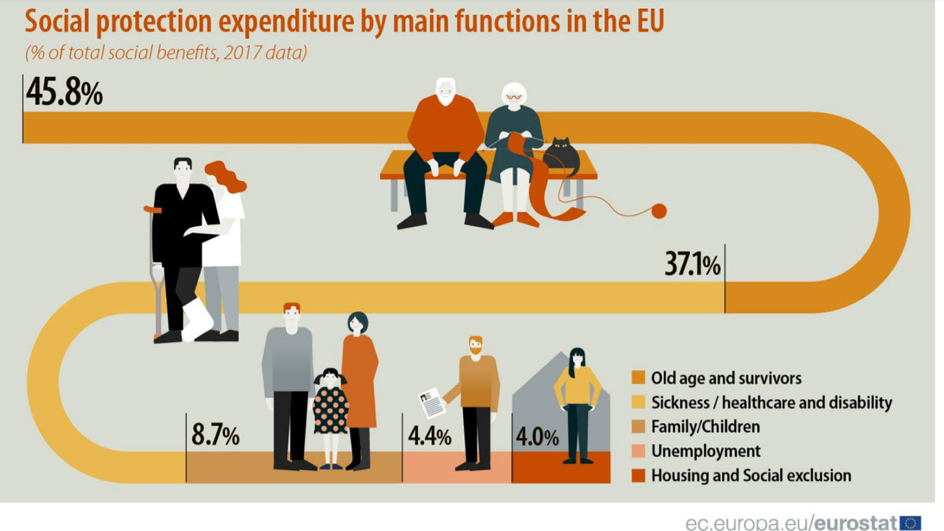

As a potential tool to fight ageism in the labor force, and to potentially replace child support and old-age pensions, a UBI system indexed to age could be a solution. This could include people from their birth until their death, fighting precarity for the whole population. It would also imaginably replace child support, student allowances, unemployment benefits, housing help, and old-age pensions. In 2016, old-age pensions accounted for three quarters (76.6 %) of all pension benefits in the EU, while survivors’ pensions accounted for over a tenth (11.4 %) and disability pensions for 6.6 %. The ratio of EU old-age benefits relative to GDP rose from 9.8 % in 2008 to 11.1 % in 2013, before decreasing slightly to 10.9 % in 2016. In 2017, annual median net income for men in the EU aged 65 and over was 12.2 % higher than that for women.[5] In 2017, the total expenditure on social protection benefits in the EU-28 amounted to EUR 4 131 billion, which was equivalent to 26.8 % of gross domestic product (GDP). An analysis by function reveals that the highest levels of expenditure in the EU-28 were recorded for the old age and survivors function (largely composed of pensions), which accounted for close to half (45.8 %) of the total expenditure on social protection benefits in 2017. The next highest share, accounting for almost three tenths (29.6 %) of the EU-28’s expenditure on social protection benefits, was for the sickness/health care function, while each of the remaining four functions (shown in Table 1) accounted for single-digit shares. Among these, the highest proportion was recorded for the family/children function (8.7 % of total expenditure on social protection benefits), followed by disability (7.6 %), unemployment (4.4 %), and housing and social exclusion (4.0 %).[6]

An Age-Indexed Basic Income (AIBI) would replace most benefits, including public old-age pensions. It would leave people with the choice of retiring when they want to, but motivate them to work as long as UBI is too low for the lifestyle they plan to have during retirement. This would also allow people to pay for additional private retirement funds if planning to retire earlier or to save money during their careers. One method to administer such a reform could be to index it to age for certain parts of life only. As an example, UBI could increase from birth until the age of 20, stay the same from 20 to 60, and start increasing again indexed to age after that. With the lack of a better name, this original idea could be called the AIBI. This does not mean that it would have to replace every welfare scheme out there. Benefits for people with disabilities and specific other necessary schemes would logically stay in place and be potentially cumulated.

This article aims to present an original policy alternative to the mainstream view of how UBI should be administered. Although most of the research will be qualitative, quantitative data from research regarding examples of the cost of current welfare programs and implementing UBI will be employed. Data from the Finnish government’s pilot program and academics studying UBI will be used. There will not be any specific geographic focus as UBI and the AIBI are potential and adjustable policy alternatives for any welfare state. However, data from the European Union will be employed mostly. The European Union is heterogeneous in its members’ demographic compositions, public pension systems, and public debt levels.

Nonetheless, UBI and the AIBI are redistribution system reforms that can be adapted depending on the country’s economic and institutional situation. The political feasibility and existing social security systems vary from country to country. The monthly UBI or AIBI allowance in Denmark would differ from the one in Portugal, for instance. This research should benefit policymakers, voters, and academics, providing useful insight into redistribution reform schemes and offering a comprehensive understanding of the subject. This paper’s novelty lies in conceptualising the original concept of AIBI, challenging the mainstream view on UBI being ideally totally universal and unconditional. Some of the questions that should be at least partially answered by this paper include the following ones:

What attributes should a redistribution system reform have?

Could UBI ever realistically be geniunely universal, unconditional, and equal for everyone receiving it while keeping existing social programs in place?

Which existing welfare programs would UBI need to replace to be affordable?

2. Theoretical approaches and conceptual scheme on the attributes of redistribution reform schemes

The leading theory employed in this paper and the conceptual scheme employed to analyse the attributes a welfare policy alternative should have is Rawls’ Theory of Justice. As stated by the American philosopher John Rawls, the natural distribution is neither just nor unjust; nor is it unjust that persons are born into society at some particular position. These are simply natural facts. What is just and unjust is the way that institutions deal with these facts.[7] In A Theory of Justice, a book published in 1971, John Rawls came up with the concepts of Original Position and Veil of Ignorance. The Stanford Encyclopaedia of Philosophy describes the original position as a central feature of John Rawls’s social contract account of justice, “justice as fairness,” set forth in A Theory of Justice. It is designed to be a fair and impartial point of view that is to be adopted in our reasoning about fundamental principles of justice. In taking up this point of view, we are to imagine ourselves in the position of free and equal persons who jointly agree upon and commit themselves to principles of social and political justice. The main distinguishing feature of the original position is “the veil of ignorance”: to insure impartiality of judgment, the parties are deprived of all knowledge of their personal characteristics and social and historical circumstances. They do know of certain fundamental interests they all have, plus general facts about psychology, economics, biology, and other social and natural sciences. The parties in the original position are presented with a list of the main conceptions of justice drawn from the tradition of social and political philosophy, and are assigned the task of choosing from among these alternatives the conception of justice that best advances their interests in establishing conditions that enable them to effectively pursue their final ends and fundamental interests. Rawls contends that the most rational choice for the parties in the original position are two principles of justice: The first guarantees the equal basic rights and liberties needed to secure the fundamental interests of free and equal citizens and to pursue a wide range of conceptions of the good. The second principle provides fair equality of educational and employment opportunities enabling all to fairly compete for powers and positions of office; and it secures for all a guaranteed minimum of all-purpose means (including income and wealth) individuals need to pursue their interests and to maintain their self-respect as free and equal persons.[8] This theory is useful for research on redistribution system modernisation when analysing whether a reform idea can be justified in terms of ethics.

According to Mazmanian and Sabatier, policy implementation is the carrying out of a basic policy decision, usually incorporated in a statute, but which can also take the form of important executive orders or court decisions. The starting point is the authoritative decision. It implies centrally located actors, such as politicians, top-level bureaucrats and others, who are seen as most relevant to producing the desired effects. In their definition, the authors categorize three types of variables affecting the achievement of legal objectives throughout this entire process. These variables can be broadly categorized as: tractability of the problem(s) being addressed; the ability of the statute to favorably structure the implementation process; and the net effect of a variety of political variables on the balance of support for statutory objectives.[9] The Barriers to the practical implementation of redistribution reform schemes need to be studied to understand the political feasibility of reforms such as UBI or the AIBI.

The economic feasibility of redistribution reforms can be analysed in terms of the reform’s net cost and the consequences of the reform on the national economy. The coronavirus crisis has increased public debt levels, making the net cost of redistribution reform alternatives important. Reforms need to be affordable. Theories such as Modern Monetary Theory can be employed when looking at the financing of such reforms. Nevertheless, economic theory should be employed on the AIBI in further research. This discussion paper is limited in space, and the economic feasibility will only be measured in terms of costs here.

The following simplified conceptual scheme shows attributes a redistribution reform scheme should have to be a viable policy alternative. This scheme includes a branch on economic feasibility. This discussion paper will focus on the net cost, policy process, and fairness of redistribution reforms. As already stated, further research should employ economic theory to look deeper into the economic effects of the AIBI. The following scheme could likely include a branch on how the model deals with globalisation or climate change, but due to the limitations linked to short discussion papers, these parts were not included in this paper. They could be studied in further research to be done on the AIBI. For a redistribution reform scheme to be viable, it should be economically feasible in terms of its net cost and not harm the economy. Its potential policy process should be smooth enough for policymakers to push for it. Finally, it should be fair and efficient at fighting poverty.

3. Social spending in the EU

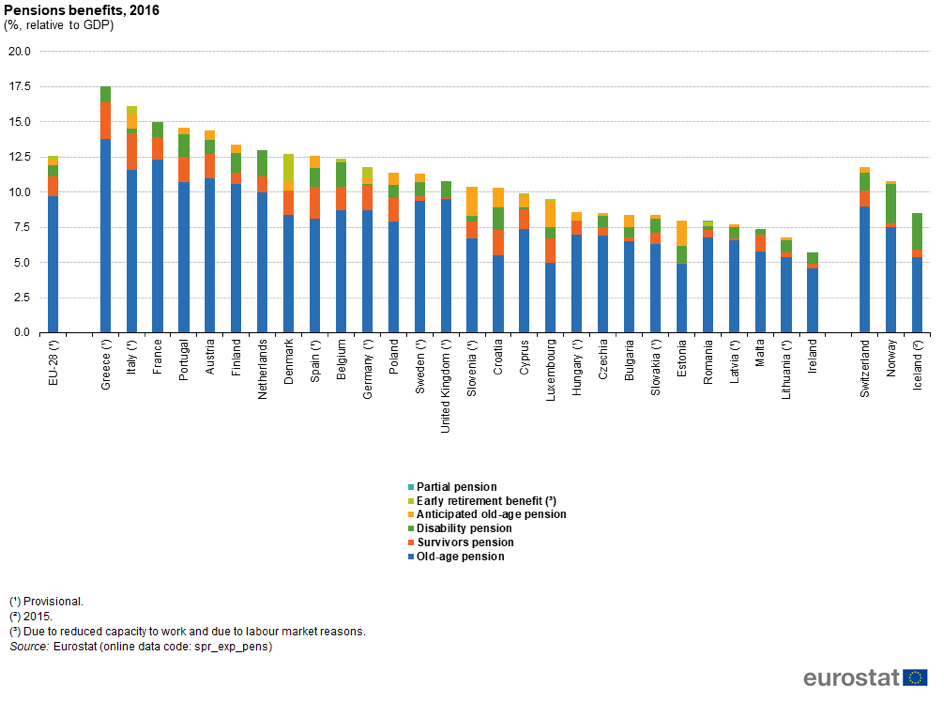

There are different types of social programs, including pensions. To understand which pensions could be replaced by UBI, it is necessary to understand these programs’ costs and role. In the majority of the EU Member States (21 out of 28), some people are beneficiaries receiving more than one type of pension. For example, it is possible, depending on national rules, for a beneficiary to simultaneously receive a survivors’ pension and an old-age pension.[10] The different types of pensions according to the European system of integrated social protection statistics (ESSPROS) are disability pensions, early retirement in case of reduced ability to work, old-age pension, anticipated old-age pensions, partial retirement pensions, survivors’ pension and early retirement for labour market reasons.[11] The following graphs from Eurostat demonstrate the percentage relative to GDP spent by EU members on pensions benefits in 2016 for the first one, and the share of total social expenditure spent on different social protection programs, including pensions.

Old-age and survivors pensions account for a large share of total social program expenditures in the European Union. European countries diverge on social spending and social measures, but old-age and survivors pensions represent the highest pension spending in each country. As the net cost tends to be an issue with UBI, replacing those old-age and survivors pensions could be an idea of making it more realistic financially. The average debt to GDP ratio in the European Union was 79,4% in 2019, before the coronavirus crisis.[14] With this level of debt likely to increase, the net cost of massive reform programs is paramount.

4. Universal Basic Income as a policy alternative and issues it faces

There is a growing amount of research on UBI. Literature to follow include research by academics such as Philippe Van Parijs and Heikki Hiilamo. The OECD, International Labor Office, Finnish Government, and IZA Institute of Labor Economics are examples of institutions that have done in-depth research on UBI. Philippe Van Parijs’ works, such as Competing Justification of Basic Income, Real Freedom For All, and A Capitalist Road To Communism, are key literature for UBI. Tony Atkinson was as well a key figure in the Basic Income debate. Combining theoretical reasoning with rigorous empirical analysis, his work systematically confronted and disentangled the key objectives and constraints of universal income support. Among his numerous notable contributions are his 1995 book ‘Public Economics in Action’ (Atkinson, 1995), which examined a combined Basic Income and flat tax proposal in a comprehensive public-finance perspective, including a tax-benefit model to examine the fiscal consequences of a Basic Income in the United Kingdom for both government and households across the income spectrum. His more recent book, ‘Inequality: what can be done?’ (Atkinson, 2015), proposed a Basic Income as part of a suite of policies designed to reduce inequalities. The fiscal and distributional effects of a concrete Basic Income scenario was, again, assessed in the specific socio-economic and policy context of the United Kingdom.[15]

The Finnish basic income experiment generated huge international attention. It was the first statutory nation-wide randomised field experiment on basic income. However, contrary to a common misunderstanding, the experiment did not study universal basic income, but partial basic income targeted to young and long-term unemployed. The government of Finland cannot be blamed for the fact that the international discussion around the experiment was completely blown out of proportions. There are still important take-home messages. The experiment demonstrates that the problems that young and long-term unemployed individuals experience in finding work do not relate to bureaucracy or financial incentives. Similarly, the results show that financial incentives for employment and reduction of benevolent bureaucracy should not be used as selling points for basic income. The results also call into question the punitive workfare policies based on the deterrent effect of unemployment services.[16] The full report on the basic income experiment also included the results of a survey measuring Finnish popular opinion on basic income. In the survey, 46% of respondents agreed or somewhat agreed with the statement that a basic income should be introduced as a permanent part of the Finnish social-security system.[17]

There are other examples of countries of partial implementations of UBI, and the covid19 crisis likely had its impact on the society’s vision on UBI. As an example of that, to fight the current situation related to the covid19 crisis, Spain’s Socialist-led government plans to launch a monthly basic income scheme for the most vulnerable households hit by the coronavirus crisis. The plan is expected to be approved (…) and will aim to reach at least 100,000 households initially.[18] The covid19 crisis’ impact is another factor widening the gap between the powerful rich and powerless poor. However, the fact that it does not concern the whole population makes this a non-universal UBI model. New technologies and monetary theory on how to finance reforms such as UBI have also been developed, making simple income tax-based pilot programs seem potentially obsolete.

At first blush, universal basic income seems a very attractive idea, especially to a progressive. Yet it suffers from two serious problems. First, the odds are very high that an effort to secure Universal Basic Income would prove quixotic. Second, and more disconcerting, any possibility of overcoming the formidable obstacles to Universal Basic Income will almost certainly require a left-right coalition that has significant conservative support — and conservative support for Universal Basic Income rests on an approach that would increase poverty, rather than reduce it.[19] Some Basic Income supporters stress that it would be universal. One often hears that means-tested programs eventually get crushed politically while universal programs do well. But the evidence doesn’t support that belief. While cash aid for poor people who aren’t working has fared poorly politically, means-tested programs as a whole have done well.[20] UBI’s universal and unconditional sides make it less bureaucratic and less sensitive to people’s varying life situations.

Perhaps the simplest way of introducing a Basic Income would be to take existing cash benefits paid to those of working age and to spread total expenditure on these benefits equally across all those aged below normal retirement age. However, the resulting Basic Income amount would be much lower than the poverty line for a single individual. Therefore, without any additional taxes, a budget-neutral Basic Income will be very far from eradicating poverty, whereas a Basic Income set at the poverty line would be very expensive.[21] According to the OECD, rather than reducing the overall headcount of those in poverty, a Basic Income would change the composition of the income-poor population. In all countries, a reduction in poverty among those currently not covered by social protection systems would be offset by some of those who are covered by existing social protection systems and who lose out from the introduction of a Basic Income moving into poverty.[22]

The International Labour Office made a study of how much UBI would cost in each country, showing two scenarios and current social spending. These cost estimates assume that UBI would be set at the level of the national poverty line, which represents a nationally accepted measure of the level of income necessary to meet basic needs and reach a minimum standard of living. Two scenarios are presented:

I. A basic income transfer at 100 per cent of the national poverty line for all adults and children.

II. A basic income transfer at 100 per cent of the national poverty line for adults and 50 per cent to children up to 15 years old.

For most world regions, the average costs of both scenarios are in the range from 20 to 30 per cent of GDP. This is the case for the East Asia and the Pacific, Europe and Central Asia, and South Asia. For the Middle East and North Africa, average costs are slightly lower, and for the Americas slightly higher. However, SubSaharan Africa stands out with substantially higher average costs. By income category, the average costs of both scenarios are between 20 and 30 percent of GDP for high-income, upper-middle-income and lower-middle income countries, but dramatically higher for low-income countries.[23]

When it comes to the attributes on a well-functioning redistribution scheme shown in the second part of this paper, most mainstream versions of UBI have a high net cost, as such a model keeps expensive existing programs such as old-age pensions in place while adding itself. This is a problem for its economic feasibility, as a high net cost would mean that governments implementing it would either have to increase taxes or take debt to finance it. Modern Monetary Theory enthusiasts would argue that governments taking debt or printing money would not be an issue, but that is, for example, not possible for members of the Eurozone.

The policy process of mainstream versions of UBI would be tricky. Implementing this policy alternative would require replacing some existing programs, and possibly cutting on public administration related to those canceled social programs. As it can be quite difficult to lay off public servants in many European countries, it would likely be needed not to replace some of those retiring instead, which is a prolonged process. Ongoing trials faced considerable legal, administrative and institutional challenges during implementation; notably, the need for a separate legal framework to enable a temporary exemption of participants from active labour market policies, taxation, and social insurance contributions. This was compounded by fiscal concerns in some countries, leading to intense conflicts between the central and local levels, with the latter fearing substantial curtailments to their local tax basis. These experiences would clearly speak to a transition to full coverage, rather than proceeding through isolated experiments creating major legal and moral problems. This is not to deny that implementing UBI effectively is a long-term challenge and would imply profound administrative, legal and institutional changes to the current system, notably a reorganization and redefinition of the links between the various tiers, in particular with regards to insurance mechanisms. Furthermore, the question of the central State and its responsibility in adequately financing social policies would also need re-opening.[24] A UBI would generally follow the same payment administration and provision processes as any other cash transfer, with the only major differences being the larger number of claimants and the use of the individual as the assistance unit with UBI (versus the 222 Christina Lowe, Margaret Grosh, Tina George, and Ugo Gentilini household unit as used for many other cash transfers). Both of these factors dramatically expand the number of payments administered, increasing the appeal of a digital payment system (in which money is transferred electronically into recipients’ financial institution or mobile money account, rather than manually distributed in cash or check form at local payment points). Government capacity for e-payments, as well as the state of the payments infrastructure (detailed later in this chapter), is currently inadequate for a UBI in most low- and middle-income countries. Thus, countries interested in a UBI might first improve payment structures before rolling out a UBI and/or rely on a mix of manual and digital methods to deliver a UBI scheme. (…) If implemented, as an unconditional entitlement, a UBI would not need to monitor recipients’ compliance with any of the conditions stipulated by conditional cash transfer or job search/ labor activation schemes. However, monitoring systems would still be required to ensure that complete and on-time payments were made to all intended recipients and not paid to any duplicate, fraudulent, or deceased recipients.[25] The implementation would also be complicated. As the savings coming from public administration cuts would take years, policy evaluation would take years to show results, which is longer than most electoral cycles. It can be challenging to motivate policymakers to make such complicated long-term choices with results taking years to show when electoral cycles tend to be short. When it comes to barriers to actual implementation, there is also the demand-capacity paradox — that is, a UBI is feasible where it is not really demanded and needed; and where it is needed, it is not feasible — reminds us that where a UBI is feasible and not demanded, there may be a good reason to not have a UBI at all.[26]

When it comes to being a fair policy alternative, Van Parijs used Rawls’ theories in his writings to justify UBI. In A Capitalist Road To Communism, he wrote that maximising the guaranteed income in absolute terms could be justified on the basis of John Rawls’ well –known ‘’difference principle’’ : it would amount to eliminating all income inequalities that are not required if the least advantaged — here identified as those who have no income, in cash or kind, apart from the guaranteed minimum — are to be as well off as possible.[27] When it comes to fighting poverty, there seem to be mixed results on existing research when comparing UBI to means-tested social programs, as stated earlier in this part. The Finnish pilot program showed debatable results. It would make sense to think that a high UBI would be effective at fighting poverty, as it would take away the problem of non-take-up rates that exist in means-tested models. The situation where people don’t access benefits that they have a right to is described as “non-take-up”.[28]

5. Original policy idea: the Age-Indexed Basic Income

As already explained in the introduction part of this paper, to tackle the cost issues faced with mainstream Universal/Unconditional versions of UBI, it is simply required to find solutions to decrease its net cost. This would require to decrease its cost as a single social program and replace as many existing programs as possible with it. To do so, UBI should replace as many existing redistribution programs as possible, while still being high enough to be effective at fighting poverty. Old-age and survivors’ pensions representing such a large share in European social benefits programs would be interesting to cover them with UBI. UBI’s cost being so high, replacing child benefits and old-age pensions would potentially give governments enough savings to pay for this expensive policy alternative.

In 2015, expenditure per beneficiary across the EU-28 (excluding Poland) averaged EUR 20 287 for unemployment pensions, EUR 15 372 for anticipated old-age pensions and EUR 14 853 for old-age pensions.[29] Between 2008 and 2015, the total number of pension beneficiaries in the EU-28 (receiving at least one type of pension) increased overall by 3.0 %, while pension expenditure (measured in constant price terms) rose by 13.4 %.[30] In a country such as Finland, an AIBI could, for instance, start at 350 euros a month from birth until the age of 18, then increase to 550 euros a month from the age of 18 until the age of 62, to 850 euros from the 62 until 68, and finally 1000 euros from the age of 68 until death. That is just an example of how it could be organised, and the numbers are, of course, to differ and be debated separately in each country. Taxes would finance the program, and money that has already been paid into retirement systems could be transferred into private retirement funds that would be optional and complementary to the AIBI for those who wish to earn more during retirement. Replacing all those programs would simplify bureaucracy and allow for a smaller number of public sector servants administering social benefits, decreasing the net cost of the reform.

When it comes to the attributes of a well-functioning redistribution reform scheme shown in the second part of this paper, although the AIBI would replace more existing programs than most mainstream UBI propositions, the increase that comes with age would also potentially make it extra expensive as a single social program. However, its net cost should be lower, as old-age pensions account for such a high share in most European countries’ social spending.

Its policy process would be further complex than a mainstream version, as more existing programs would need to be replaced. Solutions would need to be found for people who have already been paying for old-age pensions during their careers. The transition period from the old system to the AIBI would likely be a long one. On top of those downsides to the policy process, the AIBI would have the other policy process issues earlier stated on the part on mainstream versions of UBI. The demand-capacity paradox is almost as much an issue with the AIBI as it is with UBI, except that the AIBI might be a bit more realistic in countries that need to fight poverty as its net cost should be a bit lower than UBI’s. When it comes to other issues linked with administering such a redistribution scheme, they are the same for the AIBI as the ones stated for UBI in the earlier part.

In terms of fighting poverty fairly, it is hard to predict whether it would be any different from UBI’s mainstream versions. When using Rawls’ Theory of Justice, the only difference between UBI and the AIBI would be the age criterion. However, as UBI is automatically paid to anyone eligible to get it, and as the AIBI would replace more existing programs than mainstream versions of UBI, non-take-up rates would decrease. Thus the number of people being in extreme poverty due to those non-take-up rates should decrease as well. The AIBI’s dependence on age as the only criterion differentiating beneficiaries is nevertheless questionable, as current means-tested redistribution systems react to more than one criterion. Excluding them would likely mean losing the necessary sensitivity of redistribution systems to diverse life trajectories and conditions of beneficiaries.

Nevertheless, with a high enough monthly allowance from the AIBI, extreme poverty should be alleviated in countries implementing it. The AIBI’s lack of sensitivity to people’s life situations that is due to it having a single criterion is real. However, the age criterion of the AIBI is still one more criterion than UBI has. Replacing and canceling most existing pension programs does not mean that specific pensions such as those for disabled people would not stay in place. That would not be an issue financially, as those pensions take way less space in European countries’ social spending than the replaced pensions do.

6. Conclusion and recommendations

Mainstream versions of UBI as policy alternatives are both expensive and challenging to implement. The potential total cost of such reforms does not only depend on the amount distributed monthly multiplied by the number of people benefitting from it. It is also directly linked to the savings the reforms could create by replacing existing programs, and simplifying or even downsizing public administration. Instead of looking at UBI’s total cost as a program, the net cost should be looked at. The more welfare programs can be replaced by it, the lower the net cost will be, and thus realistic a future full-scale implementation will become. The mainstream view on UBI shows it ideally as totally universal and unconditional. Universal Basic Income’s daunting financing challenges raise fundamental questions about its political feasibility, both now and in the coming decades. Proponents often speak of an emerging left-right coalition to support it. But consider what Universal Basic Income’s supporters on the right advocate. They generally propose Universal Basic Income as a replacement for the current “welfare state.” That is, they would finance Universal Basic Income by eliminating all or most programs for people with low or modest incomes. If you take the dollars targeted on people in the bottom fifth or two-fifths of the population and convert them to universal payments to people all the way up the income scale, you’re redistributing income upward. That would increase poverty and inequality rather than reduce them.[31] Introducing a Basic Income while leaving important existing benefits (such as early retirement pensions) in place would limit losses among current benefit recipients. But, at unchanged Basic Income levels, such a reform would cost much more than the scenarios considered in this paper and require a determined effort to broaden the revenue base for financing social protection.[32]

For a redistribution system reform scheme to be efficient, fair, and implementable, it needs to have a realistic net cost, a smooth enough policy process for policymakers to want to engage in it, and it needs to be efficient at fairly fighting poverty. UBI could likely not be truly universal, unconditional, and equal for everyone while keeping existing social programs in place in the sense that it would probably need to be at a different level depending on age if given to the population from birth until their death. For UBI to be financially realistic to implement, it would need to either be low and not efficient at fighting poverty or to replace as many actual programs as possible. The AIBI would not solve the issues related to the implementation process of UBI, but it could solve the economic problems linked to UBI and its high cost. The AIBI’s dependence on age as its single criterion would be a downside when it comes to fighting poverty in the fairest possible, but at the same time, the AIBI would simplify bureaucracy while decreasing extreme poverty and non-take-up rates, and that criterion is still one more than what UBI has. The AIBI would do all of this at a lower net cost than UBI. This paper aimed to present the idea of AIBI. It is a new policy alternative, and more research should be done on it to understand it. It is a flexible, modernised version of UBI, and it could be adapted to countries depending on their economic situation and culture. How much people would get from it and at which age it would increase would be up to each countries policymakers depending on what they see as best. Several hypotheses could be included in further research on the subject. The coronavirus crisis’ impact on the society’s vision on UBI should be looked into. The effect of the AIBI on the national economy and its difference with UBI’s effect on it should also be studied. A case study or simulation of the implementation of the AIBI would cost in different European countries after the cuts its implementation would require would be interesting to better understand its political feasibility.

7. References

Anh Nguyen, Quynh; Acuña-Ulate, Andrés; Behrendt, Christina; Ortiz, Isabel. 2018. Universal Basic Income proposals in light of ILO standards: Key issues and global costing.

International Labour Organization.

‘Basic Income Earth Network’ 2018. https://basicincome.org/. Accessed November 21, 2018.

‘British Broadcasting Corporation’ 2020. https://www.bbc.com/news/world-europe-52707551. Accessed May 26, 2020.

Browne, James & Immervoll, Herwig. 2017. Basic income as a policy option: Technical Background Note Illustrating costs and distributional implications for selected countries. OECD.

Browne, James & Immervoll, Herwig. 2017. Mechanics of Replacing Benefit Systems with a Basic Income: Comparative Results from a Microsimulation Approach. IZA Institute of Labor Economics.

‘Center on Budget and Policy Priorities’ 2019. https://www.cbpp.org/poverty-and-opportunity/commentary-universal-basic-income-may-sound-attractive-but-if-it-occurred. Accessed August 2, 2020.

De Wispelaere, Jurgen & Yemtsov, Ruslan. 2020. Exploring Universal Basic Income: A Guide to Navigating Concepts, Evidence, and Practices. International Bank for Reconstruction and Development / The World Bank

European Minimum Income Network. 2014. Analysis of Welfare Benefits Systems : The case of the “Revenu de solidarité active” in France. European Antipoverty Network France.

‘Eurostat’, 2020. https://ec.europa.eu/eurostat/tgm/table.do?tab=table&init=1&language=en&pcode=teina225&plugin=1. Accessed September 5, 2020.

‘Eurostat’ 2019. https://ec.europa.eu/eurostat/statistics-explained/index.php/Ageing_Europe_-_statistics_on_pensions,_income_and_expenditure. Accessed August 7, 2020.

‘Eurostat’ 2019. https://ec.europa.eu/eurostat/statistics-explained/index.php/Social_protection_statistics_-_social_benefits. Accessed August 7, 2020.

‘Eurostat’ 2018. https://ec.europa.eu/eurostat/statistics-explained/index.php/Social_protection_statistics_-_pension_expenditure_and_pension_beneficiaries#Who_is_counted.3F. Accessed August 7, 2020.

‘Flowers, Andrew’ 2020. https://www.helsinki.fi/en/news/nordic-welfare-news/universal-basic-income-experiment-in-finland-new-research-reveals-significant-diversity-in-participants-experience. Accessed June 22, 2020.

‘Hiilamo, Heikki’ 2020. https://www.helsinki.fi/en/news/nordic-welfare-news/the-basic-income-experiment-in-finland-yields-surprising-results. Accessed June 19, 2020.

Lowe, Christina; Grosh, Margaret; George, Tina and Gentilini, Ugo. 2020. Exploring Universal Basic Income: A Guide to Navigating Concepts, Evidence, and Practices. International Bank for Reconstruction and Development / The World Bank

Mazmanian, Daniel A. and Sabatier, Paul A. 1983. Implementation and Public Policy. Glenview, III.: Scott, Foresman

Rawls, John. 1971. A Theory of Justice. Harvard University Press.

‘OECD’ 2019. http://www.oecd.org/social/inequality.htm. Accessed January 2, 2019.

‘Stanford Encyclopedia Of Philosophy’ 2004. https://plato.stanford.edu/entries/redistribution/. Accessed March 21, 2018.

Van Der Veen, Robert & Van Parijs, Philippe. 2006. A Capitalist Road to Communism. Basic Income Studies.

‘Van Parijs, Philippe’ 2020. https://www.socialeurope.eu/basic-income-positive-results-from-finland. Accessed May 20, 2020.

8. Abbreviations

UBI: Universal Basic Income

AIBI: Age-Indexed Basic Income

OECD: Organisation for Economic Co-operation and Development

GDP: Gross Domestic Product

9. Information about the author

Joni Askola is a Finnish Ph.D. Student in Public and Social Policy at the Faculty of Social Sciences of Charles University. He holds an M.A. in Politics and Economics in Eurasia from the Moscow State Institute of International Relations. His research focus is on welfare state redistribution system reform policy alternatives and his thesis supervisor is Professor Martin Potůček. His e-mail address is the following: 87680683@fsv.cuni.cz

[1] ‘OECD’, 2019

[2] ‘Basic Income Earth Network’, 2018

[3] Browne J. & Immervoll H., 2017: p3

[4] ‘Van Parijs P.’, 2020

[5] ‘Eurostat’, 2019

[6] ‘Eurostat’, 2019

[7] Rawls, 1971: p87–88

[8] ‘Stanford Encyclopedia of Philosophy’, 1996

[9] Mazmanian and Sabatier, 1983: p20–21

[10] ‘Eurostat’, 2018

[11] ‘Eurostat’, 2018

[12] ‘Eurostat’, 2019

[13] ‘Eurostat’, 2019

[14] ‘Eurostat’, 2020

[15] Browne J. & Immervoll H., 2017: p2

[16] ‘Hiilamo H.’, 2020

[17] ‘Flower A.’, 2020

[18] ‘BBC’, 2020

[19] ‘Center on Budget and Policy Priorities’, 2019

[20] ‘Center on Budget and Policy Priorities’, 2019

[21] Browne J. & Immervoll H., 2017: p3

[22] Browne J. & Immervoll H., 2017: p24

[23] International Labour Organization, 2018: p13

[24] Haagh Louise & Rohregger Barbara, 2019: p19

[25] Lowe, Christina; Grosh, Margaret; George, Tina & Gentilini, Ugo, 2020: p221–223

[26] De Wispelaere Jurgen & Yemtsov Ruslan, 2020: p203

[27] Van Parijs Philippe & Van der Veen Robert, 2006

[28] European Minimum Income Network, 2014: p20

[29] ‘Eurostat’, 2018

[30] ‘Eurostat’, 2018

[31] ‘Center on Budget and Policy Priorities’, 2019

[32] Browne J. & Immervoll H., 2017: p21